Blowing Your Mind with the Rule of 72

InvestingNumbers have a way of surprising you sometimes. Add a bit of time to them and they can blow your mind. Take for instance the Rule of 72. This is a formula to determine how long it takes for money to double depending on a certain interest rate. For example, with an interest rate of 10%, your money doubles in 7.2 years. 72/Interest Rate = Your money x 2. Just think about that. So if you have $250,000 in 7.2 years you could have $500,000 with a 10% interest rate. So what about 10 years later? Yep.... $1,000,000. That is pretty incredible. Now, I am not going to say that you will get 10% for 20 years, but even if you bring that down to 5%, you could still have a cool million well within your lifetime. This magical wealth machine is powered by compounding interest. You are essentially making money from the returns that you earned previously... and it doesn't stop. If you don't touch the money it will just keep growing... and growing... and growing.

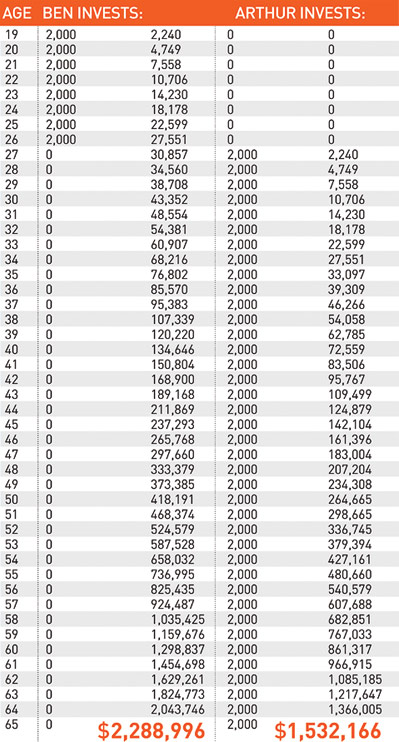

Most people have the heard the hypothetical story of two brothers where one saves early on for 10 years and the other starts later and saves for twice as long. Naturally, your mind thinks saving more and for longer results in more money, but it doesn't. The early saver has more money and has been sitting on the beach drinking margaritas for the last decade while brother 2 is stuck on the interstate commuting back from work. Why don't people learn this stuff in High School? Or from their parents? Or their friends? I was told of the Rule of 72 by my High School Economics teacher and by my Dad (numerous times). It really sunk in when I was about 25. When you are young, time seems to be infinite and money isn't a priority. You feel like you have a lifetime to make up the money you are spending at the bar or on a trip with your friends. Lucky for me, I had a Dad who knew about money, investing, and compounding. He basically told me anything is better than nothing. Even you can't max out an IRA, put in a few hundred. Get the employeer match in your 401k... It is free money. And it leads to free money for the rest of your life.

Life can be cheap if you want it to be, but most don't want that. They want things... They want to live how they grew up ignoring the fact that their parents spent a lifetime getting to where they are. New car? Yep, I have a job. New house? Yep, I need a garage for my car. Trip Mexico? Yep, I haven't seen my friends for a while. I am guilty of all of those things... but at least I bought a small house, a modest car, had a free flight for the vacation, and contributed to an IRA. We are all young and make some mistake, but the irony is that it is the young folks that can't afford to not start investing young. The money that your investments will bring you is more than you will make at your day job. It is never too late. Start saving ASAP and live the dream when everyone else is regretting not taking advantage of time, money, compounding and the Rule of 72.

Take a look at the graph below showing the magic of compound interest and between Ben and Arthur.